If you're in the market for a home loan or already have one, you may have come across the term "offset account." But what is an offset account and how can it help you manage your mortgage more effectively? In this blog, we'll delve into the world of offset accounts, explaining what they are, how they work and their potential benefits and drawbacks.

An offset account is a financial tool closely linked to your home loan. It serves as a transaction account that can significantly reduce the interest you pay on your mortgage, ultimately helping you pay off your loan faster. The concept is quite straightforward: the more money you have in your offset account, the less interest you'll accrue on your home loan.

In most cases, to take advantage of an offset account, your home loan should have a variable interest rate. However, some lenders do offer offset features on fixed-rate loans, but they might be less common. So, if you're keen on finding a fixed-rate loan with this feature, a bit of research can be rewarding.

Did you know Beyond Broking has access to a vast network of over 50 lenders, providing us with an extensive range of options to find a loan with an offset account that aligns perfectly with your broader financial objectives.

Using an offset account can be tailored to your individual preferences and financial habits. To maximise its benefits, it's advisable to set up your regular pay cycle to deposit directly into the offset account and use it as a means for regular savings. Some banks even permit you to have multiple offset accounts, making it easier to keep track of your finances.

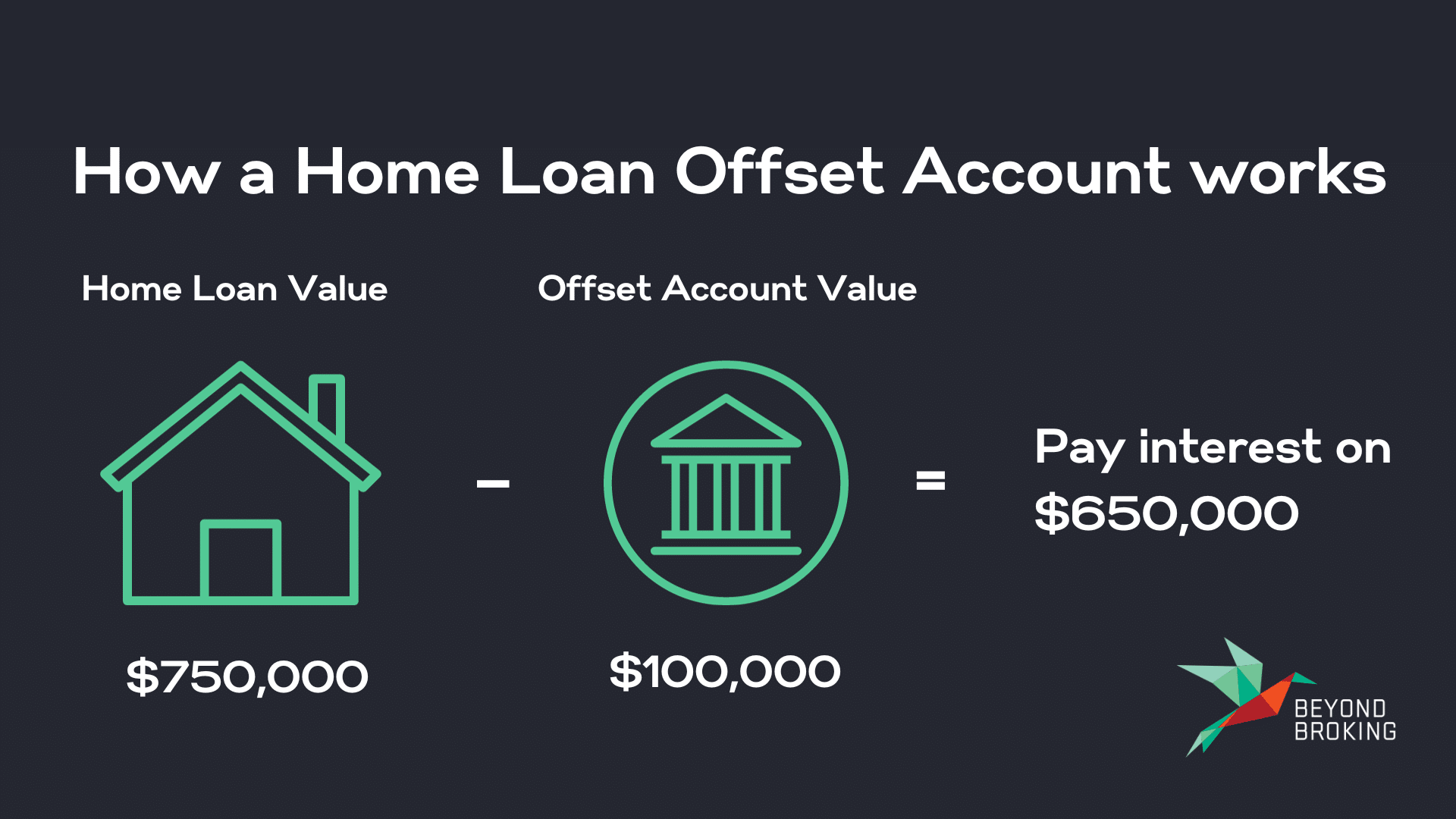

Let's break down how an offset account works with a simple example. Suppose you have a home loan of $750,000, and you deposit $100,000 into your offset account. Here's the magic: you will only be charged interest on $650,000 of your loan, not the full $750,000. Your minimum monthly repayment remains the same, but the interest component decreases, allowing you to pay off more of the principal. This interest-saving effect continues as long as you maintain a substantial balance in your offset account.

As brokers with accounting backgrounds, our expertise uniquely positions us to assist you not only with your home loan but also in identifying how an offset account can be beneficial by examining your complete financial situation and long-term objectives.

While offset accounts offer substantial advantages, it's essential to be aware of their potential drawbacks:

An offset account can be a powerful financial tool that can help you save money on interest and pay off your home loan sooner. However, it's crucial to weigh the benefits against any associated fees and the interest rate implications. To determine the best mortgage structure for your unique circumstances, consider consulting with a mortgage broker, like Beyond Broking. We can provide you with advice specific to your situation and help you make the most informed decision regarding offset accounts and other mortgage options.

So, if you're considering a home loan or already have one, explore the possibilities of an offset account – it could be the key to a faster path to mortgage freedom. We provide complimentary consultations and would welcome an opportunity to help you determine if an offset account is worthwhile for you. Give us a call on 1300 462 396 or fill out the form below to book your complimentary consultation with Beyond Broking.